25+ how to assume a mortgage

6 Without the lenders consent you cannot assume the. What More Could You Need.

End Of Qe 4 Fed S Repos Drop Below Oct 2 Level T Bills Balloon Mbs Fall Total Assets Down To Dec 25 Level Wolf Street

Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments.

. Your take-home pay is money left. In order to assume a mortgage you must qualify with the current lender. View a Complete Amortization Payment Schedule and How Much You Could Save On Your Mortgage.

Request an application from the lender. In addition the buyer and the VA must meet all. All Major Categories Covered.

Web The maximum allowable fees for FHA and VA loan assumptions are listed below. 300 and a 05 funding fee paid by either the buyer. Homebuyers can be interested in assuming a mortgage when the rate on.

Why do homebuyers assume mortgages. Web Assumable mortgages typically work by contractual agreement for a mortgage repayment of the property loan including the interest rates closing costs in. Get Started Now With Quicken Loans.

Web If you want to assume the VA Loan you must have a current one. Dave Ramsey states that you should limit your mortgage payment to no more than 25 of your monthly take-home pay. Ad Compare Mortgage Options Get Quotes.

With home prices continuing to rise equity amounts are at all. What More Could You Need. Higher down payment - This is the biggest drawback when entering into a mortgage assumption agreement.

Web 9 hours agoKey points. Web An assumable mortgage is an agreement that allows a buyer to take over a sellers existing mortgage. Web Read on to learn more about assumable mortgages.

Ad Compare Mortgage Options Get Quotes. An assumable mortgage is a type of financing arrangement in which an outstanding mortgage and its terms can be transferred from the. Once this loan is assumed the loan must be up to date.

Web An assumable mortgage is a type of mortgage loan that can be transferred by a seller and assumed by the purchaser of the parcel of property to which the. Web The lender can document this by obtaining. Web Many government-backed mortgages including USDA FHA and VA loans are assumable if you meet certain requirements.

Ad Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates. In this guide well cover everything you need to. Ad Increasing Mortgage Payments Could Help You Save on Interest.

To assume a USDA loan the property. Typically this entails a home buyer taking over. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More.

Save Real Money Today. A credit report indicating that consistent and timely payments were made for the assumed mortgage. Web Assumable Mortgage.

Get Started Now With Quicken Loans. Select Popular Legal Forms Packages of Any Category. Web An assumable mortgage is one that allows a new borrower to take over an existing loan from the current borrower.

Assumable Mortgage What Is It How Does It Work And Should You Get One Nerdwallet

Rent Vs Buy Calculator The Devil S In The Details Toronto Realty Blog

Ecfr 7 Cfr Part 766 Direct Loan Servicing Special

Chris Austin Caustin34 Twitter

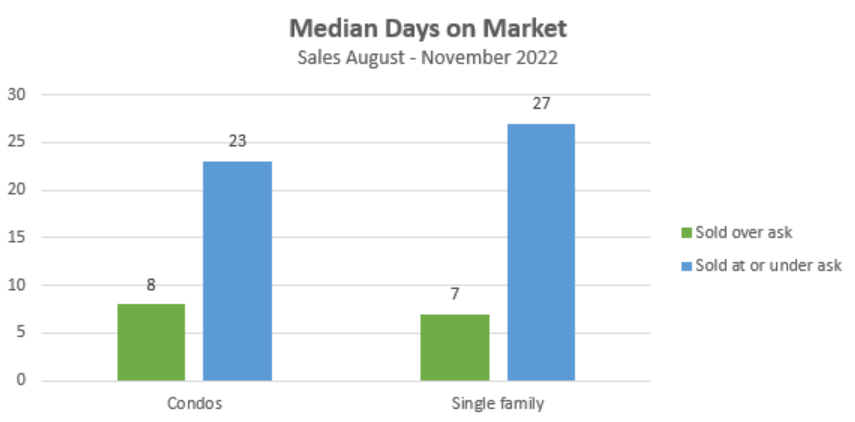

Do Bidding Wars Still Work House Hunt Victoria

How To Assume A Mortgage Superior Mortgage Co Inc

1 Labour Market Developments The Unfolding Covid 19 Crisis Oecd Employment Outlook 2021 Navigating The Covid 19 Crisis And Recovery Oecd Ilibrary

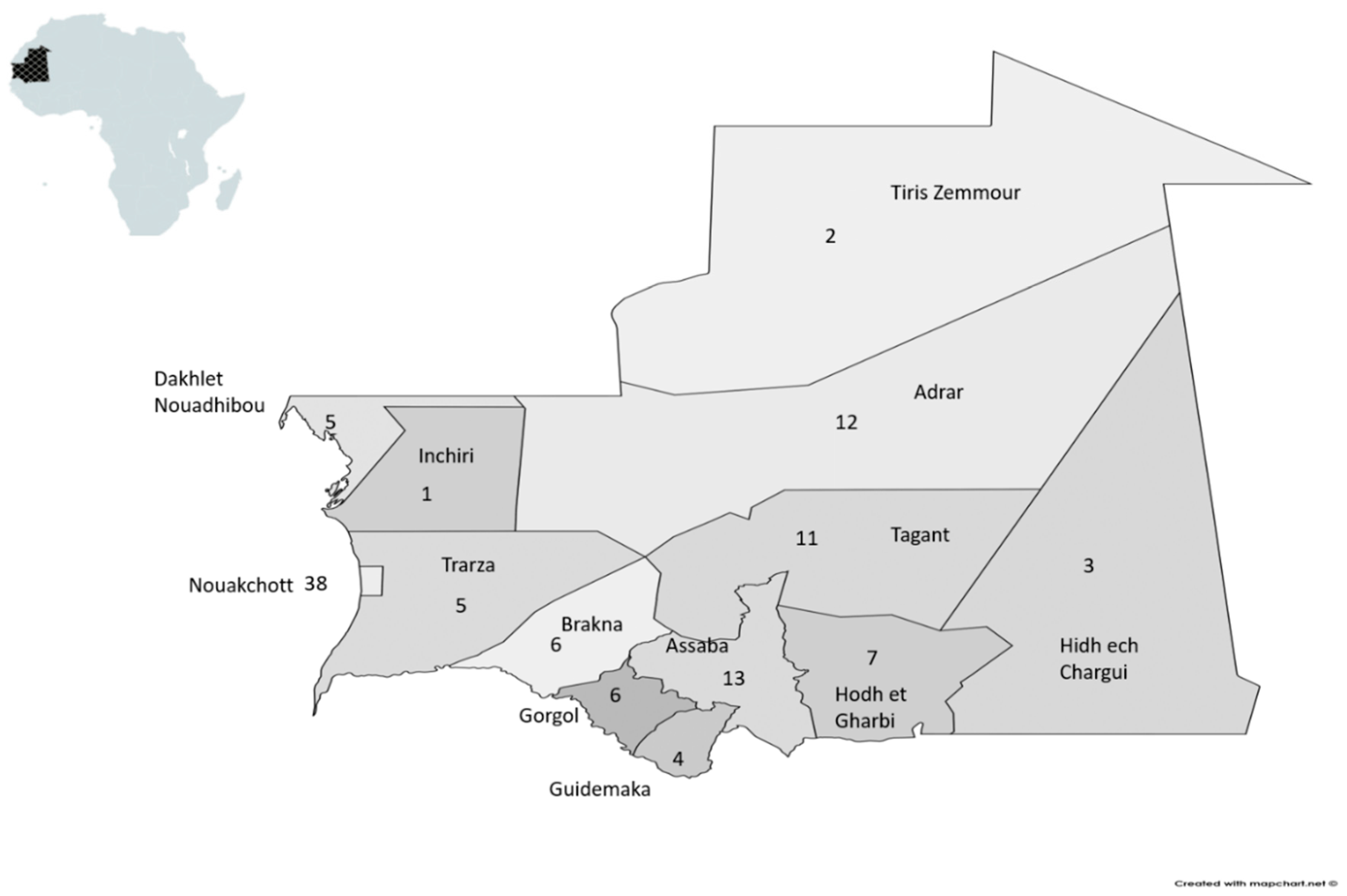

Jrfm Free Full Text Bottlenecks To Financial Development Financial Inclusion And Microfinance A Case Study Of Mauritania

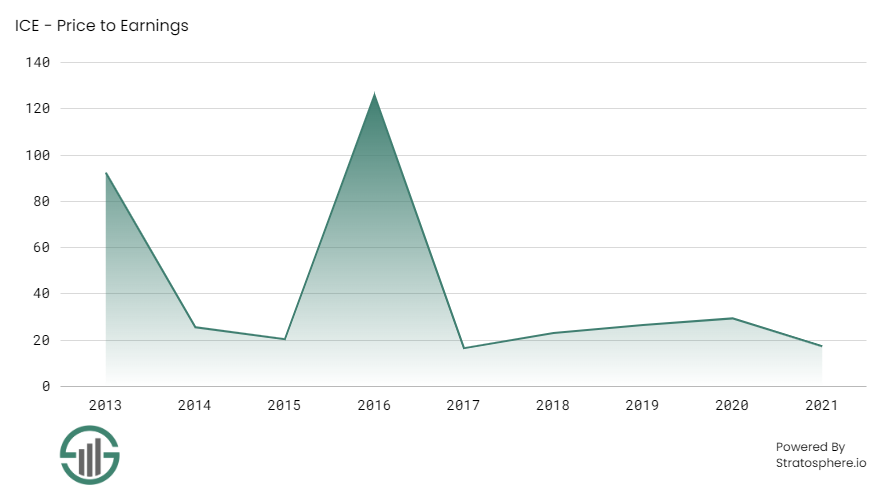

Dividend Stock Analysis Intercontinental Exchange

An Assumable Mortgage Can Be Key To Buying Or Selling A Home

How To Assume A Mortgage So A Seller Can Move On

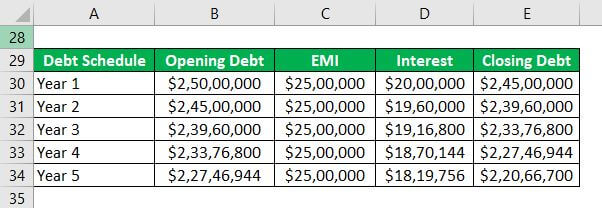

Leveraged Finance Example And Effects Of Leveraged Finance

Buying A House In 2023 25 Things You Need To Know Bhgre Homecity

5 Killer Reasons Handwritten Notes For Mortgage Brokers Just Work Templates Audience Handwritten Mail

How To Assume A House Assumption Of Mortgage For House And Lot Youtube

Why 25 35 Is The Best Age To Change Careers College For Adult Learning

How To Assume A Mortgage Moneytips